Solar Design Tool Select Baseline Roof

Solar Industry Growing at a Record Pace

Solar energy in the United States is booming. Along with our partners at Wood Mackenzie Power & Renewables and The Solar Foundation, SEIA tracks trends and trajectories in the solar industry that demonstrate the diverse and sustained growth of solar across the country.

Below you will find charts and information summarizing the state of solar in the U.S. If you're looking for more data, explore our resources page. In addition, SEIA Members have access to presentation slide decks that contain this data and much more. Not a SEIA Member? Join today!

Massive Growth Since 2000 Sets the Stage for the Solar+ Decade

In the last decade alone, solar has experienced an average annual growth rate of 42%. Thanks to strong federal policies like the solar Investment Tax Credit, rapidly declining costs, and increasing demand across the private and public sector for clean electricity, there are now more than 100 gigawatts (GW) of solar capacity installed nationwide, enough to power 18.9 million homes.

Solar as an Economic Engine

As of 2020, more than 230,000 Americans work in solar at more than 10,000 companies in every U.S. state. In 2020, the solar industry generated more than $25 billion of private investment in the American economy.

Growth in Solar is Led by Falling Prices

The cost to install solar has dropped by more than 70% over the last decade, leading the industry to expand into new markets and deploy thousands of systems nationwide. An average-sized residential system has dropped from a pre-incentive price of $40,000 in 2010 to roughly $20,000 today, while recent utility-scale prices range from $16/MWh - $35/MWh, competitive with all other forms of generation.

Supply Chain Constraints Lead to Price Increases

Over the last 6 – 9 months, shipping constraints and other supply chain challenges stemming from the global pandemic are leading to price increases across the U.S. solar industry. For the first time since Wood Mackenzie began modeling solar system price data in 2014, costs increased in Q2 2021 across all market segments both year-over-year and quarter-over-quarter. While many installers and developers have sufficient inventory to prevent these increases from disrupting deployment in 2021, some projects and customers may begin to see the effects early in 2022 if supply chain challenges don't abate.

Solar's Share of New Capacity has Grown Rapidly

Solar has ranked first or second in new electric capacity additions in each of the last 8 years. In 2020, 43% of all new electric capacity added to the grid came from solar, the largest such share in history and the second year in a row that solar added the most generating capacity to the grid. Solar's increasing competitiveness against other technologies has allowed it to quickly increase its share of total U.S. electrical generation - from just 0.1% in 2010 to nearly 4% today.

The U.S Solar Industry is a 50-State Market

While California has traditionally dominated the U.S. solar market, other markets are continuing to expand rapidly. In 2020, states outside of California made up their largest share of the market in the last decade, led by rapid growth in Florida and Texas. As the price of solar continues to fall, new state entrants will grab an increasingly larger share of the national market.

Prices Decline for Rooftop Solar, but Higher Soft Costs Remain

The biggest cost-decline opportunity in residential and small commercial solar exists in soft costs, which includes installation labor, customer acquisition, and permitting/inspection/interconnection. While the soft cost share of total system costs has stabilized in recent months due to increased customer demand, rising hardware costs and pandemic-related improvements to permitting practices, U.S. solar soft costs continue to be much higher than those of other developed solar markets around the world. Through programs like Solar Automated Permit Processing (SolarAPP) and SolSmart, SEIA and our partners are working to reduce local barriers to going solar.

Storage is Increasingly Paired with All Forms of Solar

Homeowners and businesses are increasingly demanding solar systems that are paired with battery storage. While this pairing is still relatively new, the growth over the next five years is expected to be significant. By 2025, nearly 25% of all behind-the-meter solar systems will be paired with storage, compared to under 6% in 2020. The utility-scale market is also recognizing the benefits of pairing solar with storage, with over 26 GW of commissioned or announced projects including storage, representing over a quarter of all contracted projects.

Residential Market Continues to Diversify

Following a record 2019, the residential solar market started off 2020 with an impressive Q1, before slowing due to pandemic-related shutdowns in Q2. The segment proved its resilience over the second half of the year however, as installers transitioned to online sales models and demand recovered. The 3.2 GW installed in 2020 represent another annual record, with 2021 on pace to eclipse that standard.

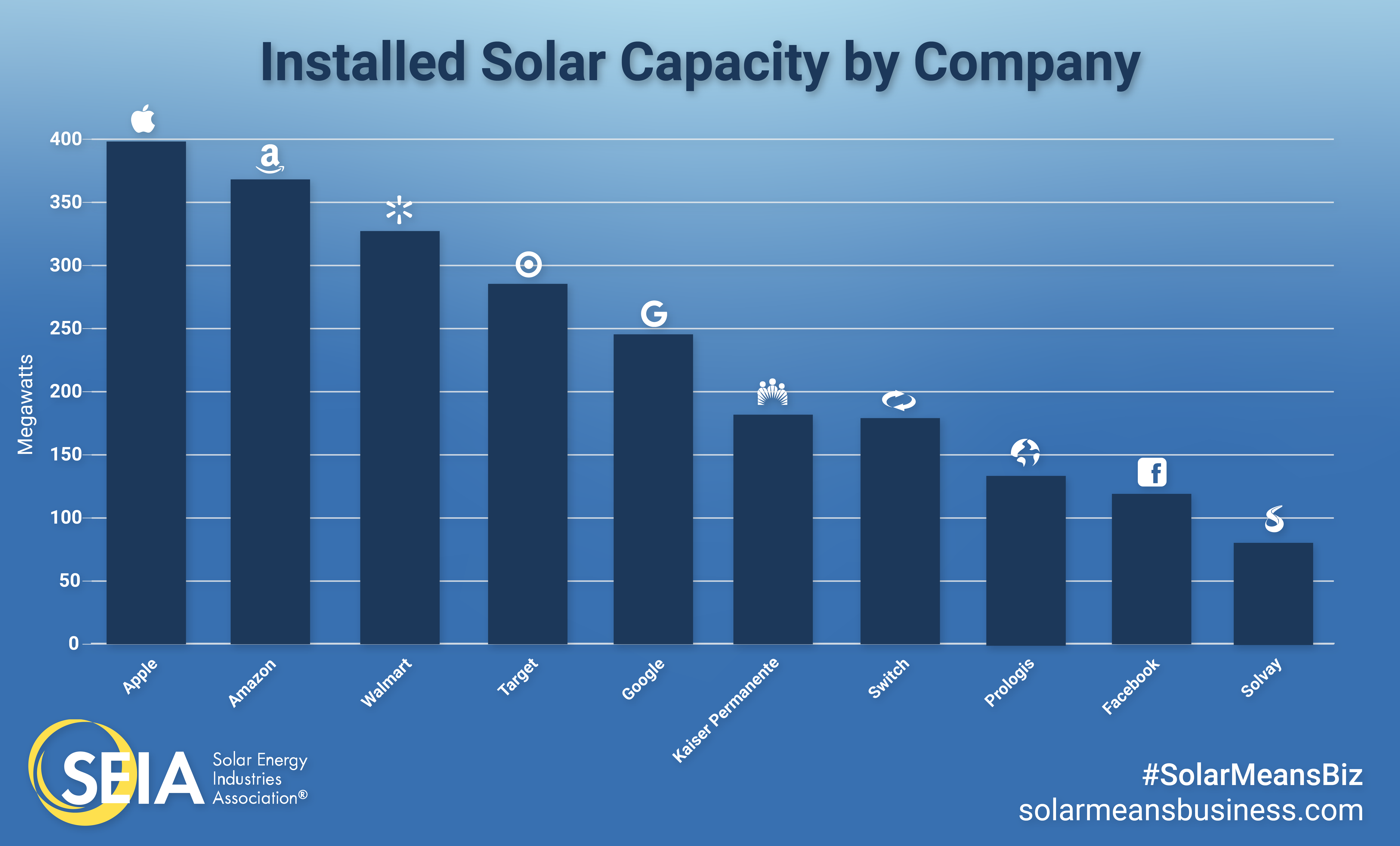

Corporate Clean Energy Goals Boost Commercial Solar

The commercial solar market, which consists of on-site solar installations for businesses, non-profits and governments, has grown unevenly in recent years as the industry continues to unlock the financing tools needed to provide access to a wide swath of business types. However, sustained adoption by large companies with clean energy goals like Walmart, Apple, Target and Amazon will help push the segment to near-record levels in 2021. With less than 1% of commercial electricity demand served by on-site solar, there remains significant opportunity for growth in this segment.

New State Entrants Help Fuel Community Solar Growth

While early growth for community solar installations was led primarily by three key markets - New York, Minnesota, and Massachusetts - a growing list of states with community solar programs have helped diversify the market, setting the stage for a record year in 2021. Continued growth in state community solar programs is imperative to ensure solar access for all types of homeowners and businesses.

Large Utility-Scale Solar Pipeline Outpaces Installs

After several years of uncertainty due to the imposition of solar module tariffs, declines in the tariff rates combined with growing clean energy goals from states, large companies and utilities have led to massive increases in utility-scale solar procurement. As of Q1 2021, the contracted pipeline sits at 85 GW, with most of those projects slated for completion before 2024, ahead of the previously scheduled step-downs for the Investment Tax Credit (which was extended by two years in late December 2020). While most developing utility-scale projects have remained on schedule despite the pandemic, increasing global prices for many inputs and the tightening of tax equity markets have the potential to create delays for some projects in the near-term.

Solar PV Growth Forecast

Despite obstacles posed by the pandemic, the U.S. solar market set a new annual record with 19.2 GW installed in 2020. With an historic utility-scale pipeline and recovering demand in the residential and non-residential segments, the industry is set for a series of record years until 2024, when the ITC is scheduled to fully step down. Barring new policy developments at the state and federal levels, industry growth through the end of the decade is premised on continued price declines and growing demand from utilities, states, corporations, and distributed solar customers. Over the next 10 years, 348 GW will be installed, more than 3 times the amount installed through 2020.

More Aggressive Growth Needed to Reach Climate Goals

While projected growth over the next 10 years puts the solar market in reach of ambitious clean energy goals set by the industry and the Biden administration, more work is needed to achieve the pace required for a 100% clean energy electricity system. Annual installs will need to grow from less than 20 GW in 2020 to more than 80 GW by 2030, with cumulative totals nearing 600 GW by the end of the decade. A combination of private sector innovation and stable, long-term public policy will set the solar industry on a path to achieving these more aggressive goals to address climate change and decarbonize the economy.

Solar Helps Fortune 500 Companies Save Money

Data from SEIA's annual Solar Means Business report show that major U.S. corporations, including Apple, Amazon, Walmart, Target, and Google are investing in solar and renewable energy at an incredible rate. Through 2019, the top corporate solar users in America have installed more than 8,300 MW of capacity across more than 38,000 different facilities across the country.

Other key takeaways:

- Corporate solar adoption has expanded rapidly over the past several years, with two thirds of all capacity installed since 2015.

- The 1,286 MW installed in 2019 represents a 10% increase from 2018 and is second to only 2017 for annual commercial deployment.

- The surge in on-site commercial solar continued in 2019, with a record 844 MW installed, while 441 MW of off-site projects were completed.

- The systems tracked in this report generate enough electricity each year to power 1.6 million U.S. homes.

You can explore SEIA's Solar Means Business report, including interactive maps and data tools on the top corporate solar users in the U.S.

Solar Design Tool Select Baseline Roof

Source: https://www.seia.org/solar-industry-research-data

Posted by: oharacompay.blogspot.com

0 Response to "Solar Design Tool Select Baseline Roof"

Post a Comment